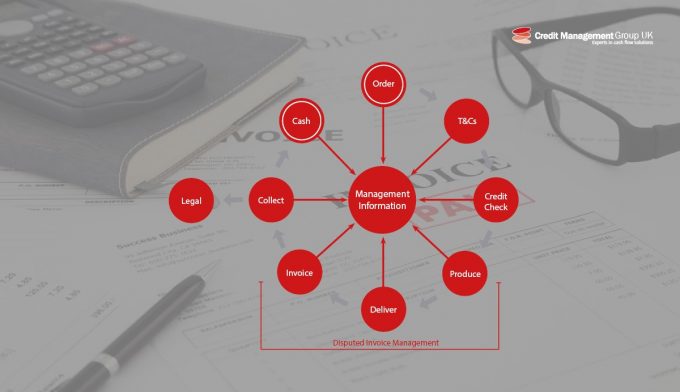

6 ways to improve the order to cash process in your business

Effective credit management covers the entire Order to Cash, not just collection activity as many wrongly assume. Ensuring that your Order to Cash Process is followed precisely and that it is continually reviewed and improved upon is vital to any business, as anything that happens during the process will ultimately affect, when or if you are paid by your customers.

The initial order

Purchase orders and/or contracts should be fully read before acceptance. You need to make sure you are aware of any contractual obligations and you can comply with them. You also need to ensure the terms don’t include anything onerous that might put your business at risk, such as unreasonably long payment terms. If there are any terms you are not happy with, do not be afraid to negotiate with your customer.

T&Cs of sale or service

Ideally, you will get your customer to sign their agreement to your terms and conditions of sale. Without signed terms, you may be able to rely acceptance by conduct, but be aware of the “battle of the forms” as it’s the last terms submitted to the other party before the contract is performed that are accepted.

Credit checking your customers

Credit checking your customers prior to carrying out any work with them can significantly reduce your risk to late or non-payment, by highlighting any issues that your customers may have with regards to their credit risk (for example, CCJs, poor payment performance, etc.). You should then monitor the customer so you receive alerts when there are any changes in their credit score or circumstances.

Producing, Delivering & Invoicing

These three stages will test the effectiveness of your disputed invoice management, if your goods and or/service isn’t as specified in your contract, if your delivery is late or goods are damaged upon delivery, or if your invoicing is incorrect, then it is very likely payment will be delayed due to disputes. It is essential that any disputes are monitored closely and resolved quickly.

Your collection strategy and moving onto legal action

A robust collection strategy is essential; this should be customer focused, but also approach collections shrewdly by identifying those customers that are high risk and therefore should take priority when chasing. High risk customers could be new customers without payment history with your company, high value invoices or those customers who have poor credit ratings.

Your collection strategy should also outline the stage at which you escalate a matter onto legal action to recover a debt. If your order to cash process is working effectively you should have everything you need to evidence that your customer has the ability to pay and that they debt is owed.

Cash

If your order to cash process is working effectively, then you should receive payment from your customer. It is essential that every stage is monitored continually and improvements are made when necessary as this could mean the difference to whether are paid or not.