Credit Management Toolkit

Welcome to CMG UK’s Credit Management Toolkit!

The credit management tools available are packed full of expert advice that is simple to follow, easy to understand and affordable.

Best of all, we have bundled our resources into handy categories so that you can simply purchase the bundle most relevant to your business’ credit management needs.

Everything will be covered…

- A step by step guide to using the Small Claims Courts

- How to credit check your customers

- The terms and conditions you need to protect your business

- Template letters, forms, calculators and in-depth guides on how to use them

- How to negotiate payment and use leverage in a customer focused way

…………And much more!

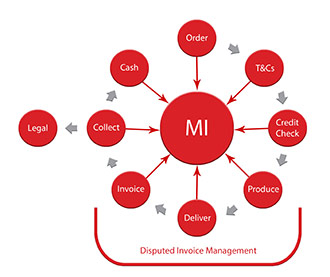

This section helps you to understand the implications of terms and conditions of sale and accepting orders Whether you are an unlimited or limited company there is specific information you need to gather to be able to carry out a credit risk assessment and to make sure you know exactly who you are trading with should you have to take legal action to gain payment. This section teaches you how to do this in a detailed way to ensure you gather the necessary information from your customers. Do you know how to handle a situation in which your invoices are disputed? This section provides you with the knowledge and guidance on how to handle these situations to achieve the payment of your invoices and maintain positive relationships with your customers. This section explores the ideal way in which to use collection letters and techniques to get your invoices paid in full and on time. We cover everything from ‘How to Give you Collection Letters Visual Impact’ to ‘How to Negotiate Payment’ and the entire process in between. When considering legal action you may find yourself wondering exactly what the process will entail and the best way to go about using the small claims courts to achieve a successful outcome. This section will provide you with a step by step guide of what to expect when you carry out legal proceedings against a debtor and the proven methods you can use that encourage a positive outcome. Credit management reports are useful to track the collection performance, by reporting key measurements every month, trends can be monitored. This section walks you through the various management reports your company should be carrying out for effective credit management.Choose the subject you would like to know more about.

Accepting Orders and Terms and Conditions

Credit Risk Assessment

Disputed Invoice Management

Collection Strategy

Taking Legal Action

Credit Management Reporting

To access our Toolkit on your computer, the minimum system requirements are below:

- Microsoft Office

- Ability to open zip files

- PDF reader

For more details, contact us on

03332 413 203